In the rapidly evolving world of finance, banking software development companies are the unsung heroes. They’re at the forefront, shaping the future of banking with innovative software solutions. These companies are revolutionizing how we manage our finances, making it easier, faster, and more secure.

But what exactly does it mean to be a banking software development company? What do they do, and why are they so crucial in today’s digital age? This article will delve into the fascinating world of banking software development, providing a clear understanding of its role in the modern financial landscape.

Banking Software Development Company

In a modern banking arena, a banking software development company plays a pivotal role. It’s their responsibility to deliver specialized software, fostering a digitally acclaimed banking environment. The implementation of specialized software promotes not just secure transactions but also enhances efficiency and customer satisfaction. By digitizing manual operations, such as balance inquiries, money transfers, or loan applications, the software minimizes errors, increases speed, and optimizes resources. For illustration, if a bank employs a manual process in loan approval, it might take days, even weeks. Comparatively, a specialized software could potentially reduce it to just a few hours.

Additionally, they have a responsibility in keeping software solutions up-to-date, conforming to the ever-evolving regulatory standards. This proactive approach mitigates potential security breaches and assures compliance, further fortifying the trust between banks and their customers. The development of user-friendly interfaces comes as a vital function, streamlining user experience, thereby fostering the bank’s digital footprint.

Key Features to Look for in Banking Software

When scouting for top-tier banking software, a few crucial elements differentiate competent solutions from the ho-hum.

Security Measures and Compliance

In our current digital landscape, security emerges as a non-negotiable feature for any banking software. A reputable banking software development company understands this urgency and prioritizes implementing robust security systems, protecting sensitive client data and financial transactions. Effective encryption and multifactor authentication systems typify top-level banking software solutions.

Moreover, regulatory compliance remains paramount in the highly monitored banking industry. Worthy banking software follows industry standards such as Payment Card Industry Data Security Standard (PCI DSS), Gramm-Leach-Bliley Act (GLBA), and the General Data Protection Regulation (GDPR).

User Experience and Accessibility

Viable banking software scores high on user-friendliness. It’s constructed with an intuitive design, ensuring that even the least tech-savvy clients can navigate with ease. Additionally, it caters to accessibility requirements, allowing universal use.

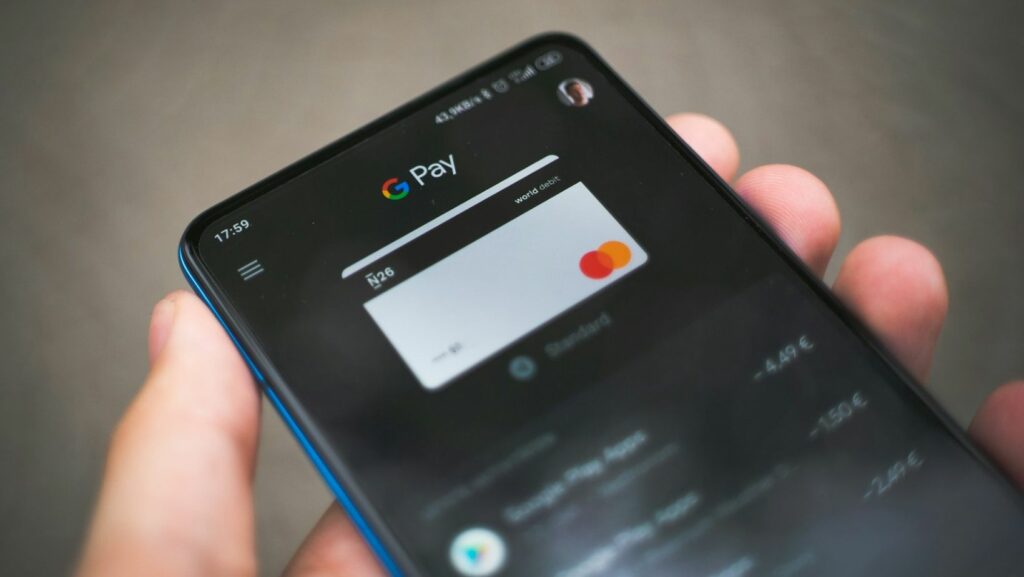

Enhanced user experience also extends to mobile accessibility. In today’s world, a vast majority prefer banking on-the-go. Strive for solutions that offer feature-rich mobile experiences as well, mirroring the ease and functionality of a desktop version.

Integration Capabilities with Other Financial Systems

Integration features stand as another vital facet when choosing banking software. A forward-thinking banking software development company designs software capable of seamless integration with other financial platforms and systems. This interoperability allows for smooth data transfer among diverse banking systems, fostering better information flow and customer service.

It’s constructive to seek software that plays well with CRM systems, payment gateways, financial analytics tools, and more. Such integrations amplify efficiency in operations, creating a unified ecosystem for streamlined banking functions.

Trends and Innovations in Banking Software Development

Blockchain technology’s introduction has brought a paradigm shift in banking software development. A banking software development company now employs blockchain technology for its superior security, transparency, and traceability. It reduces the risk of fraud, enhances payment speed, and simplifies the compliance process, transforming how banks conduct transactions.

Similarly, artificial intelligence has revolutionized banking. Companies leverage AI in their banking software to automate customer service, streamline operations, and improve user experience. AI’s predictive analysis, for instance, enables risk assessment in real-time, profoundly impacting decision-making processes.

Cloud Computing has had a significant effect on banking solutions. Banking software development companies use cloud technology to provide scalable and cost-effective solutions. It offers easy data accessibility, increased storage capacity, and reliable disaster recovery solutions, making banking operations resilient. Moreover, cloud computing’s flexible nature allows banking software to handle expanding data volumes and transactions – upholding performance, security, and customer satisfaction.